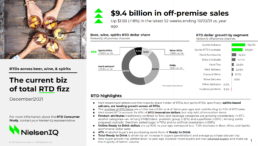

NielsenIQ: The Current Biz of Total RTD Fizz

RTD Highlights:

- Malt-based hard seltzers are the majority share holder of RTDs, but spirits RTDs, specifically spirits-based seltzers, are leading growth across all RTDs

- The number of RTD items are on the rise (+9.8% vs # of items year ago) and contributing to 20% of RTD sales

- Malt-based RTDs account for 83% of RTD innovation dollars, but only 46% of innovation items

- Product attributes traditionally confined to food and beverage categories are growing considerably in RTD alcohol categories—ex. Among FMB/Ciders: probiotic group (+32%) and superfoods (+20%) | Among spirits prepared cocktails: free from added sugar (+711%) and no artificial sweeteners (+293%)

- Online Ready to Drink dollars are up 15.1% vs year ago, compared to a -7.6% decrease in Beer, Wine, and Spirits eCommerce dollar sales

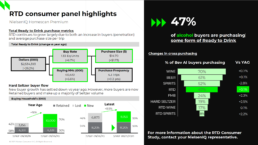

- 47% of alcohol buyers are purchasing some form of Ready to Drink

- Total Ready to Drink is driven by an increase in buyers (penetration) and average purchase size per trip

- New buyer growth has settled down vs year ago, however more buyers are now retained buyers and make up the majority of Seltzer volume

Total Ready to Drink purchase metrics

RTD continues to grow largely due to both an increase in buyers (penetration) and average purchase size per trip

Hard Seltzer buyer flow

New buyer growth has settled down vs year ago; However, more buyers are now retained buyers and make up a majority of Seltzer volume